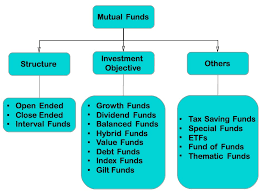

TYPES OF MUTUAL FUNDS

Mutual Fund houses (AMCs) offer a wide variety of schemes based on needs, age, financial position, risk tolerance and return expectations of various investors. These schemes can be classified into different categories and subcategories based on their investment objectives or their maturity periods.

CLASSIFICATION BASED ON OBJECTIVE

While there are a wide variety of mutual funds offered in the market, each has its own set of goals. The goal is the investment objective, set by the fund manager, based on categories of stocks and bonds that fund’s portfolio will house.

Growth/Equity Oriented Schemes

Growth/ Equity oriented schemes invest predominantly in equity and equity related instruments. These schemes aim to provide capital appreciation over medium to long term. It makes a great buy for investors who plan to invest for at least five years or more. These schemes are not for investors seeking regular income or looking to conserve capital.

Debt Oriented Schemes

The main objective of debt-oriented funds is to provide regular and steady income to investors. These schemes mainly invest in fixed income securities such as Bonds, Money Market Instruments, Corporate Debentures, Government Securities (Gilts) etc. Debt-oriented schemes are suitable for investors whose main objective is safety of capital along with modest growth. These funds are not affected because of fluctuations in equity markets. However, the NAV of such funds is affected because of change in the interest rate in the country.

Income Funds

Income Funds invest in fixed income securities such as debentures and company fixed deposits. The main aim of these schemes is to provide regular and steady income to investors. While these funds provide stability, they are sensitive to interest rates. As interest-rates go up or down, the prices of income fund shares, particularly bonds, will move in the opposite direction.

Money Market/Liquid Funds

These funds are predominantly debt-oriented schemes aimed at preservation of capital, easy liquidity and moderate income. These schemes mainly invest in short-term instruments like commercial papers, certificate of deposits, treasury bills, government securities and interbank call money etc. While these schemes pose very little risks, they rarely yield returns better than inflation, technically, eating the power of your money over the years.

Hybrid Funds

Hybrid funds are a combination of equity and debt funds. The aim of Hybrid funds is to provide both capital appreciation and stability of income to the investor. While equities provide growth potential, the exposure to debt provide stability to portfolio during volatile times in the equity markets. The proportion of investment made into equities and fixed income securities is pre-defined and mentioned in the offer document of the scheme. Hybrid Funds have low to high risk based on the Debt –Equity Ratio and are suitable for investor looking for moderate growth over the period of at least three to five years.

Hybrid Funds can be categorized in two broad categories:

Equity oriented: These funds most commonly known as balanced funds invest over 60% of the capital in equity and equity related instruments and the remaining in debt categories such as fixed income securities such as Bonds, Money Market Instruments, Corporate Debentures, Government Securities (Gilts) etc. Since these funds are treated as Equity funds for taxation purpose, they are exempt from long term capital gains tax.

Debt oriented: These funds have debt exposure of more than 40% (mostly 50 to 90%) and the rest is equities. While these funds seek to generate regular income through a predominant exposure to debt and money market instruments; it also aims at capital growth through an equity exposure. These funds are treated as debt funds for taxation purpose, and hence, attract both short term and long term capital gains tax depending on the time duration.

CLASSIFICATION BASED ON STRUCTURE

Open Ended Schemes

Open ended funds are available for subscription throughout the year and are not listed on the stock exchange. In other words, the units of these schemes can be purchased or redeemed at an time at the fund’s Net Asset Value. Majority of mutual funds are open-ended funds.

Close-ended Schemes

A closed ended fund has a fixed maturity period (generally ranging from 3 to 15 years) and has a fixed number of shares. The fund units can only be bought during a specified period. There need to be an even balance of buyers and sellers, i.e. for investors to purchase the units of the fund, another investor needs to selling them. While most closed ended funds are listed on stock exchange and are traded just like another stock on the exchange, some funds provide periodic repurchase facility to investors. More importantly, these funds terminate on specified dates after which investor can redeem the units.

The different plans that mutual funds offer to the investors are:

Growth Option

In this option, the dividends (profits) are not paid to the unit holder. The gains remain invested in the scheme and are reflected in the NAV of the units. Investor can only realize capital appreciation by selling the unit.

Dividend Option

There are two sub types in this plan:

Dividend Payout: Under this option, dividends are paid out to the investor periodically depending on available surplus. The NAV, however, gets reduced to the extent of the dividend paid out and other charges.

Dividend reinvested: The dividend declared is re-invested back to buy more units of the fund at ex-dividend NAV, therefore, allocating additional units to the investors in lieu of the dividends.